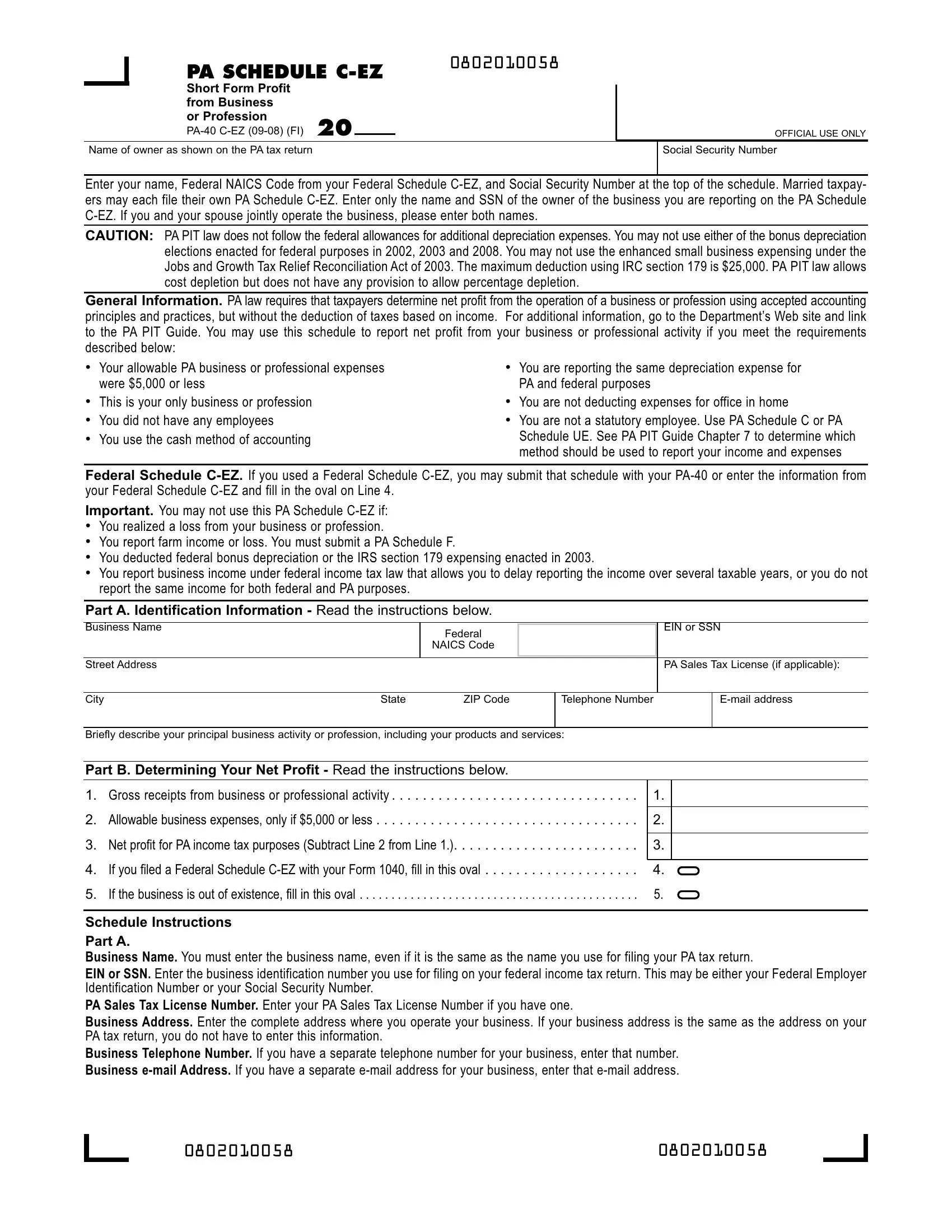

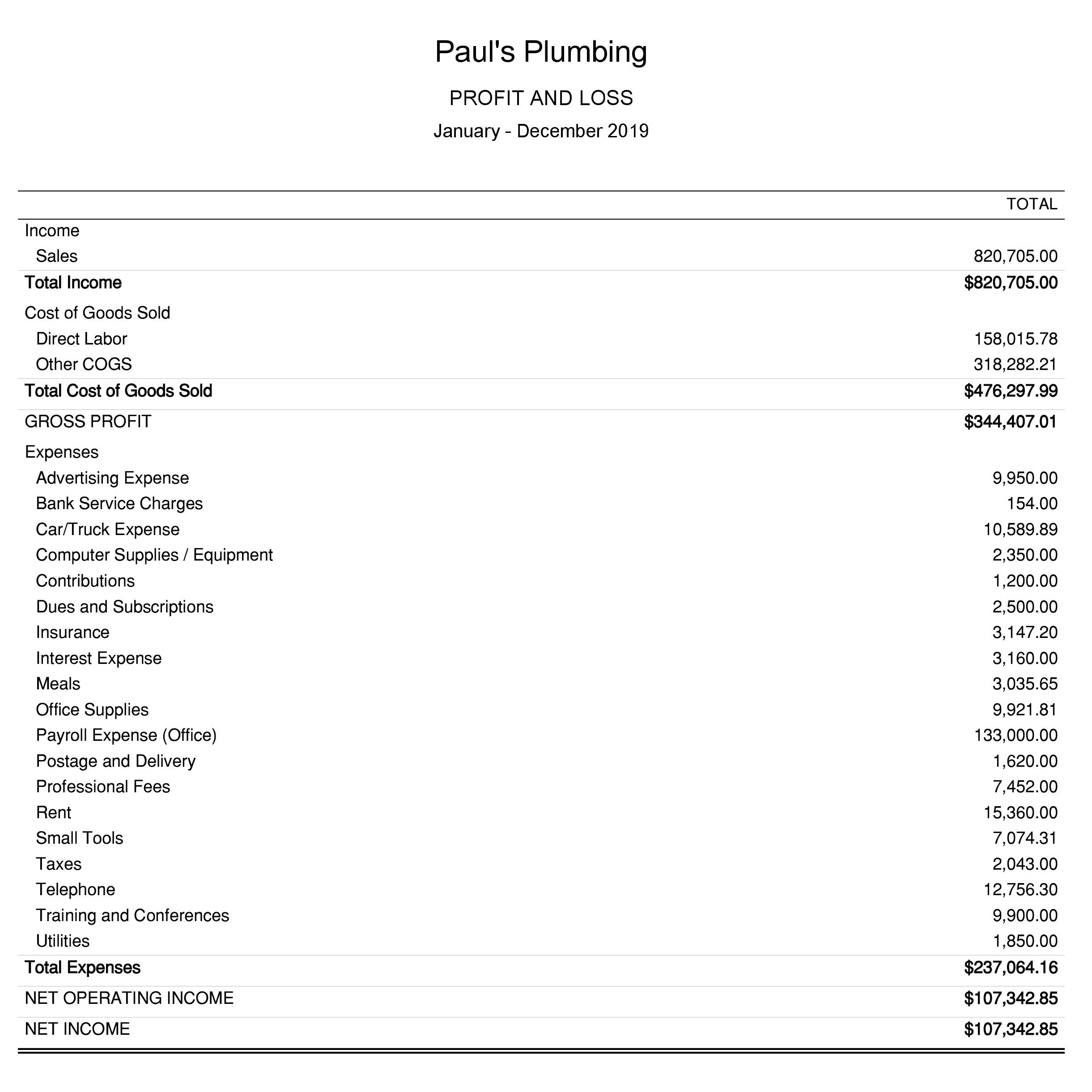

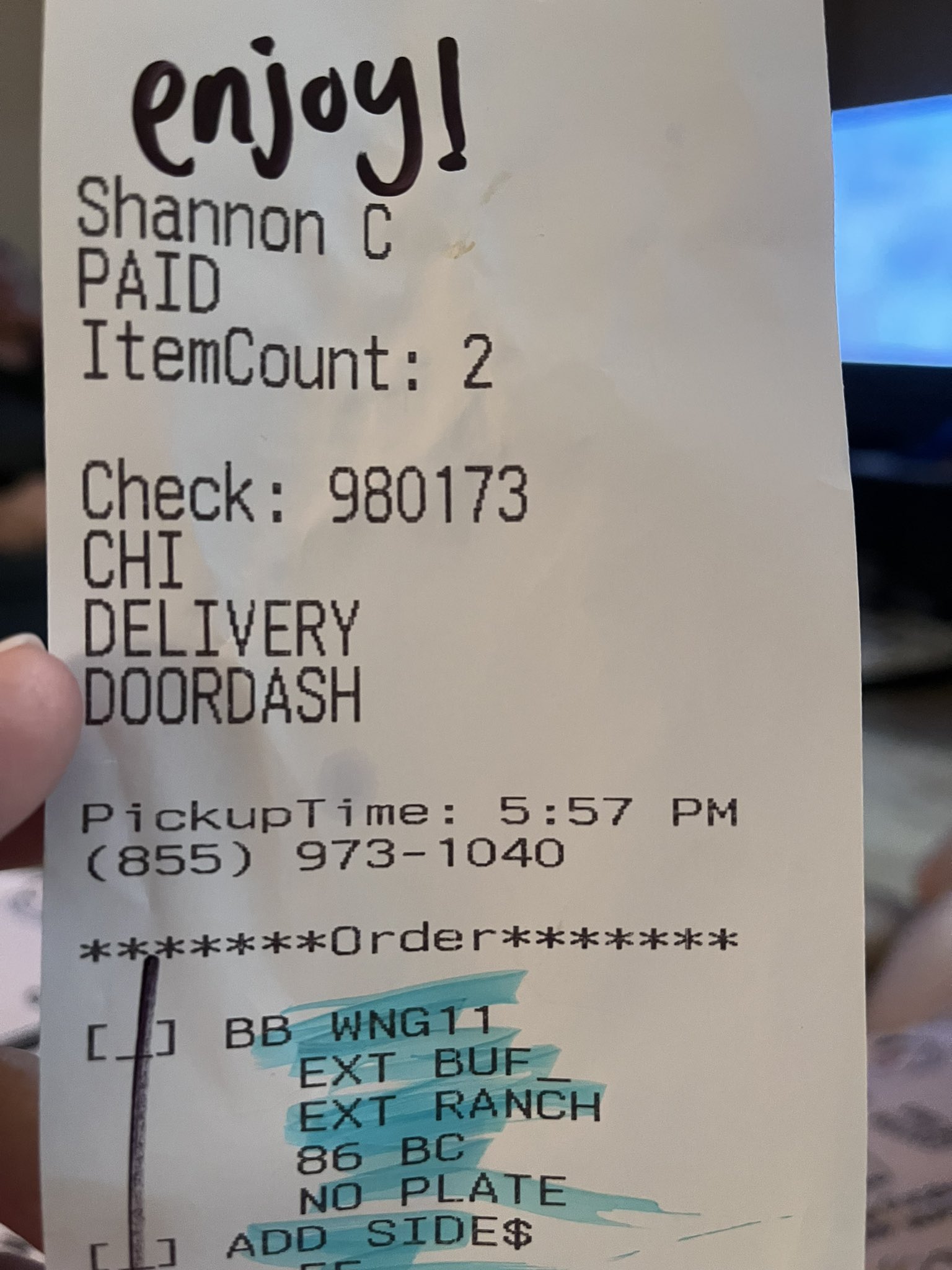

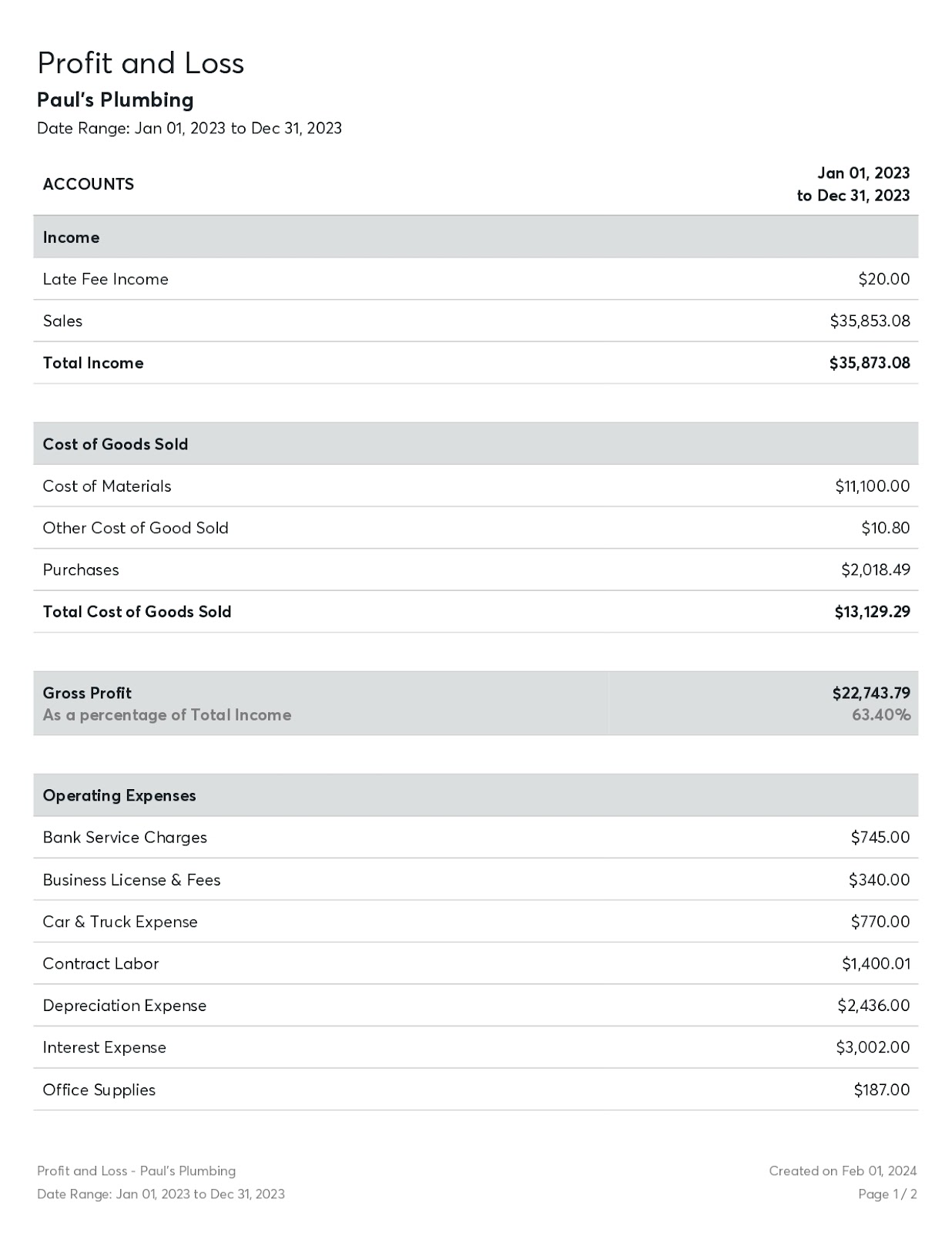

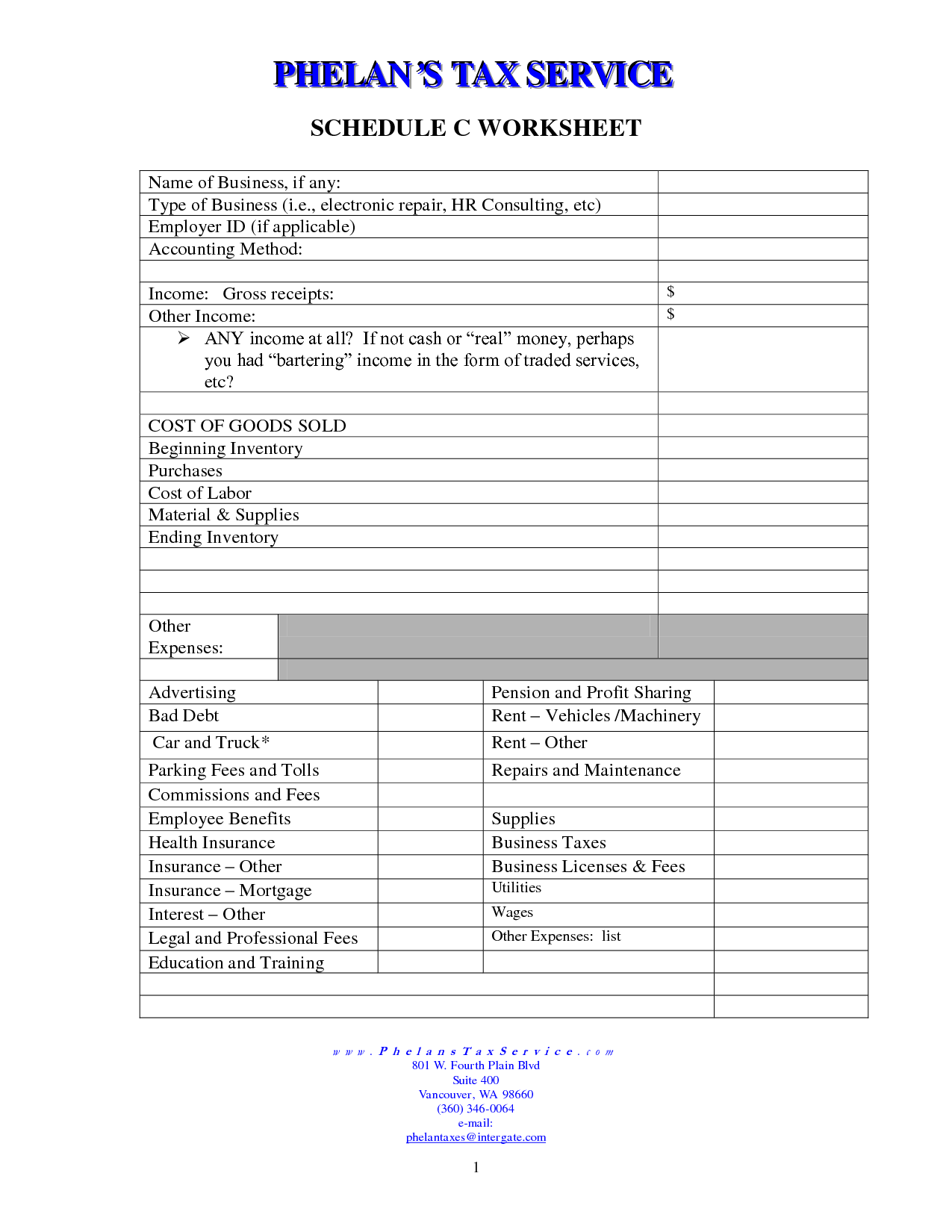

Websep 19, 2022 · schedule c is the linchpin of your independent contractor taxes. It's the form that lets you claim business expenses regardless of whether you itemize your tax. Webfilling out schedule c for your doordash business is a relatively straightforward process. Here are the key sections and questions you need to pay attention to: Webfilling out a schedule c is one of the most effective ways for doordash contractors to pay only what they owe in taxes. Documenting their business income and expenses ensures. If you want to deduct expenses related to your income then you will need. Webuse schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your.

Related Posts

Recent Post

- Hsn Recently On Air

- Aussiebum

- No Experience Jobs Las Vegas

- On By On By Lytrics

- New York City Cbs

- Part Time Jobs In Las Vegas With No Experience

- Delaware Route 1 Traffic Cameras

- Billy Joel Tour 2024 Ticketmaster

- Apartments For Rent With Utilities Included Near Me

- Selena And Aaliyah Friends

- Ajc Com Georgia Tech

- Clinton County Iowa Jail

- Kxan Sports

- Anaheim Pd Twitter

- Bryce Harper

Trending Keywords

Recent Search

- Prairie County Arkansas Sheriff

- Nba Teamrankings

- Ucsb Office Of Financial Aid

- %d8%b3%da%a9%d8%b3%db%8c %da%a9%d8%b1%d8%af%d9%86 %da%a9%d8%a7%d8%b1%d8%aa%d9%88%d9%86%db%8ccareer Search Result Html

- Nerdy Actors

- Trash Can Family Dollar

- Menards Kitchens

- Did Brandi From Storage Wars Get A Boob Job

- Ticket Geek

- Kwik Trip Corporate Jobs

- Car Crash In Winston Salem Nc

- Remote Work From Home Jobs Indiana

- Ethnocentrism Quizlet

- Richard Carnes Actor

- Remote Hiring Immediately Jobs

/GettyImages-174038203-5a4d1e6de258f80036c28e70.jpg)

:max_bytes(150000):strip_icc()/ScheduleD2022IRS-11353a1e824e41a9a83f83e39fd0f879.jpg)

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)