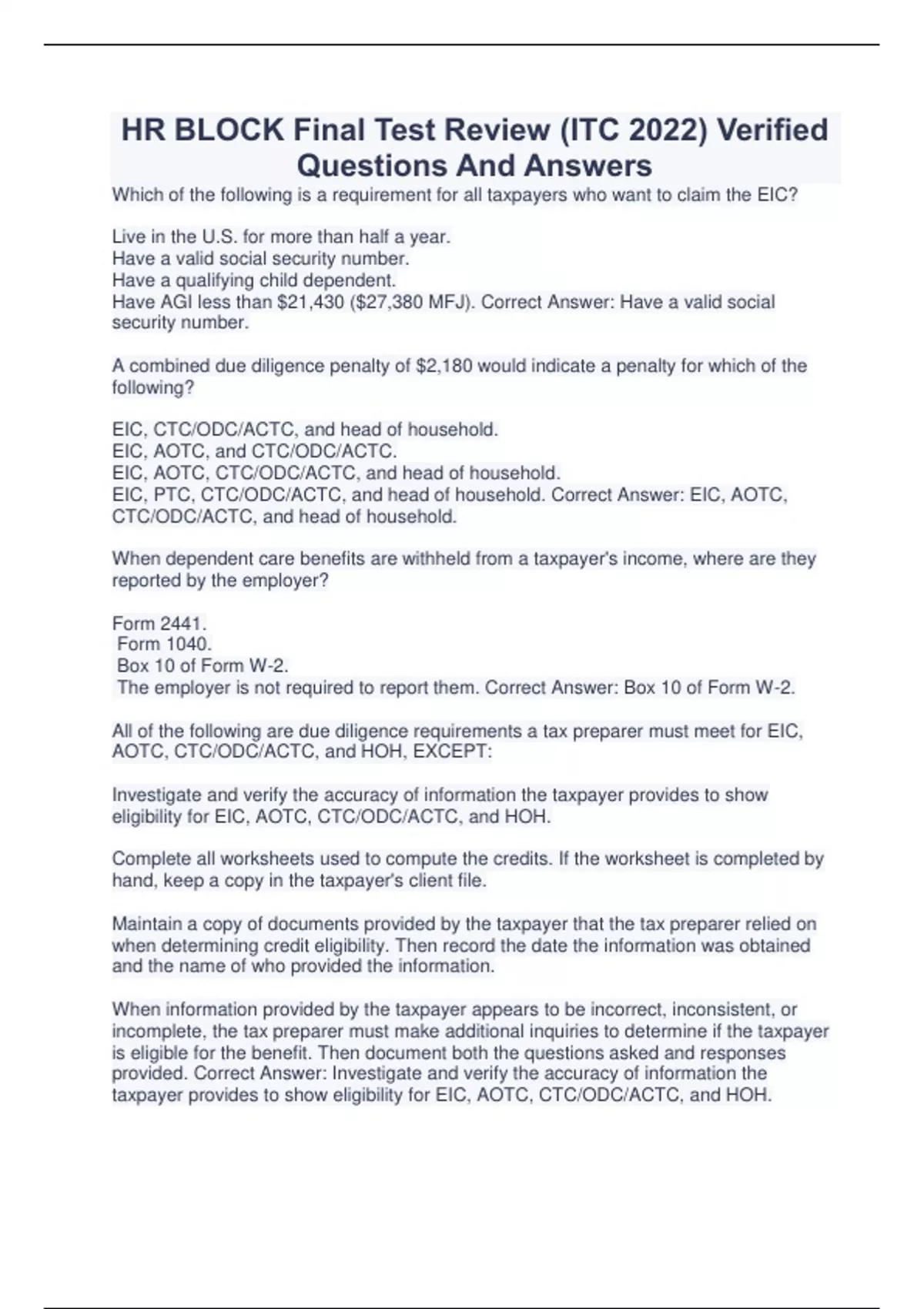

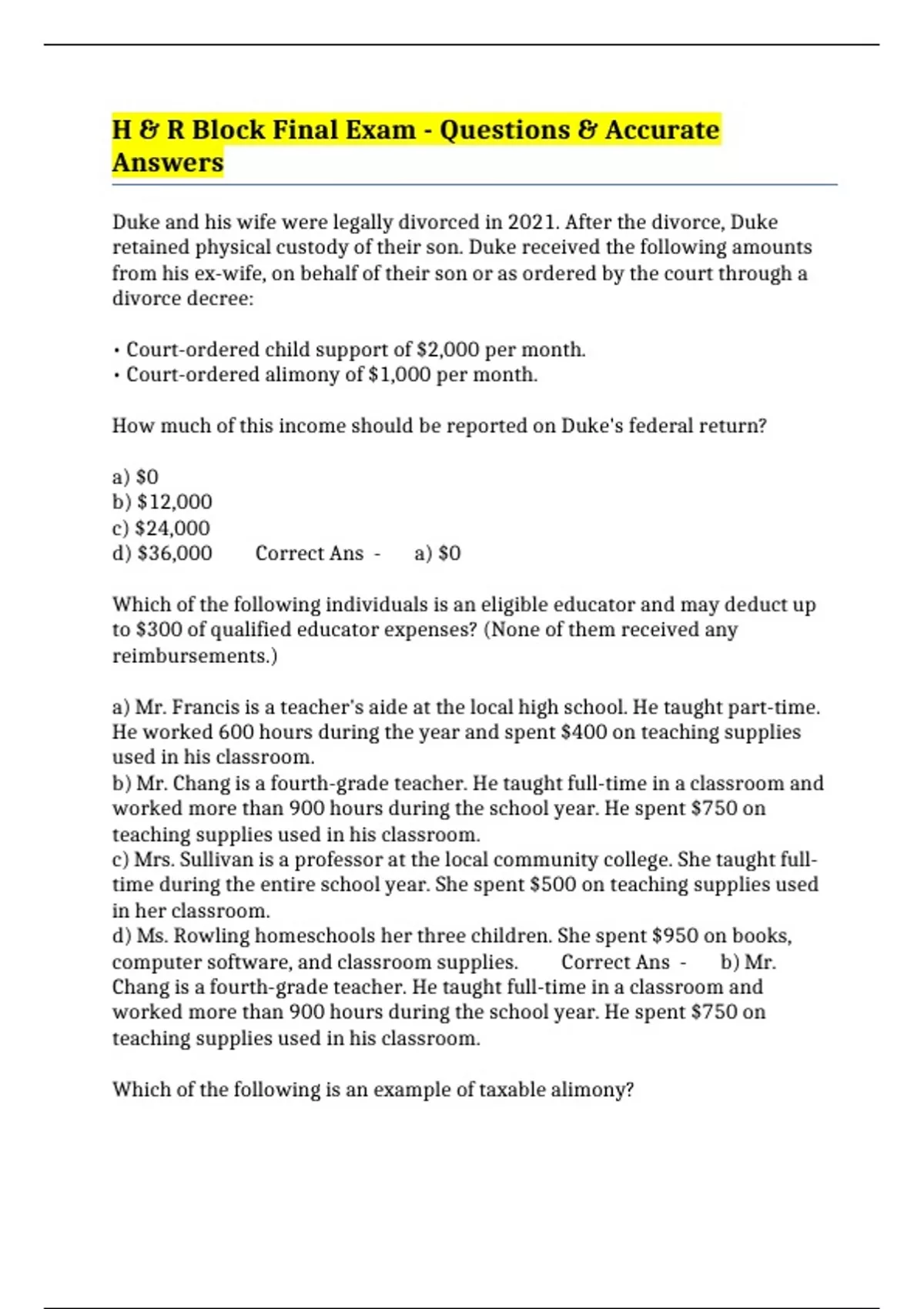

Webhe borrowed $900,000 and purchased a new main home in march of 2020. Soledad will be itemizing his deductions. On what portion of the acquisition debt will interest be deductible on soledad's tax return for 2022? Complete questions & answers (grad... Webwith these case studies, you will be able to identify the where, how, what, and how of the h&r block final exam case study answer. Some of the main characteristics of descriptive case studies include: Web3 days ago · study with quizlet and memorize flashcards containing terms like which of the following is a requirement for all taxpayers who want to claim the eic? Live in the u. s. For more than half a year. Have a valid social security number.

Related Posts

Recent Post

- Nkjv Psalms

- Merge Mansion Plaza Tasks

- Rare Penny Years List

- Joe Gun Antenna

- Daily Voice Tarrytown

- Craigslist Cash Jobs Dallas

- 511 Wi Map

- Sunday Comics Washington Post

- Alligator Scort

- Jobs In Maui Hawaii Craigslist

- Vaporeon Deviantart

- Newjetnet Sign In For Aa Employees

- Tami Nickles Obituarystatistics Html

- Kohls Com Jobs

- Giant Eagle Ceo Salary

Trending Keywords

Recent Search

- Angel Devil Tattoos Designs

- Ninjatrader Forums

- Nfl Lineup Today Rotowire

- How Far Is Helen Georgia From My Location

- Dirty Gifs For Her

- Gisd Job Fair

- 3 Man Ladder Stand

- Ge Profile Refrigerator Door Shelf Replacement

- Consumer Cellular Phones Available At Target

- Old Fishing Lures Prices

- Tractor Supply Lionville

- Too Apree Lawsuit

- Econ Job Market Rumors Marketing

- Wake Nc Mugshot Zone

- 918 Curtains